Owning commercial property through your SMSF is a powerful investment, but it comes with risks. Commercial property owners insurance shields your asset from unexpected setbacks, ensuring you're protected and compliant. Wondering if it’s right for you? Read on to find out!

This insurance provides comprehensive protection for commercial properties, covering physical damage to the building and financial risks such as loss of rental income and tenant-related issues. It’s a crucial safeguard for SMSF trustees, who are responsible for protecting the fund’s assets.

While the terms are often used interchangeably, there is a key difference between the two:

Commercial property insurance is a broad term that covers various types of commercial properties, including office buildings, warehouses, and retail spaces. This type of insurance generally covers physical damage to the property due to risks like fire, storm, or vandalism. It may also provide coverage for the contents of the property and loss of rental income, but it doesn't typically offer much in terms of liability or tenant-related risks.

Commercial property owners insurance is specifically tailored for property owners. In addition to covering the physical building and contents, it also includes liability protection for injuries or property damage that occur on the premises. Furthermore, this type of insurance can cover tenant-related risks, such as rental income loss due to tenant default or eviction costs. For SMSF trustees, this more comprehensive insurance is recommended not only to protect the property but also to ensure compliance with SMSF regulations.

SMSF trustees must adhere to Australian regulations, including a duty to exercise the same degree of care, skill, and diligence as an ordinary prudent person would when managing the affairs of others.

Key coverage recommendations include:

Maintaining insurance coverage. Under the Superannuation Industry (Supervision) Act 1993 (SIS Act), trustees have a general obligation to act in the best interests of the fund's beneficiaries, which includes appropriately managing and protecting the fund's assets. Failing to do so could breach trustee obligations.

Rental income protection. Rental income is often a significant part of an SMSF’s cash flow. Insuring against risks like tenant default or property damage is critical to meeting financial commitments and protecting members’ retirement savings, should a significant loss occur.

Public liability compliance. Trustees should mitigate liability risks associated with third-party injuries or property damage on the premises.

Building and property damage cover. This protects the structure and fixtures from risks such as fire, storm, flood, vandalism, or accidental damage.

Loss of rental income. If your commercial property becomes uninhabitable due to insured damage, this cover helps the SMSF maintain cash flow by covering lost rental income.

Tenant rent default cover. Some insurers offer protection against tenant rent default. If your property is managed by a professional agent, this covers unpaid rent up to 26 weeks if a tenant is unable to meet their obligations due to financial difficulties or abandonment of the lease.

Public liability insurance – property owners. This protects trustees from claims for injuries or property damage occurring on the premises, essential for minimising legal risks.

Glass and signage cover. This covers accidental damage to windows, glass facades, and signage on the property.

Machinery breakdown. This protects critical infrastructure like elevators, heating, and cooling systems against unexpected mechanical failures.

Strata title property cover. This complements the strata insurance policy for properties within a strata scheme, ensuring full protection for your specific unit or share.

Regulatory compliance. Trustees have a legal obligation to act in the best interests of SMSF members, including safeguarding the fund’s assets.

Mitigating financial risks. Covering potential damages, rent loss, or tenant default ensures financial stability for the SMSF.

Customisable coverage. Policies can be tailored to address the specific needs of the SMSF, the type of property, and the risk exposure.

Peace of mind. Comprehensive insurance ensures SMSF trustees fulfil their responsibilities while protecting the fund’s assets and income streams.

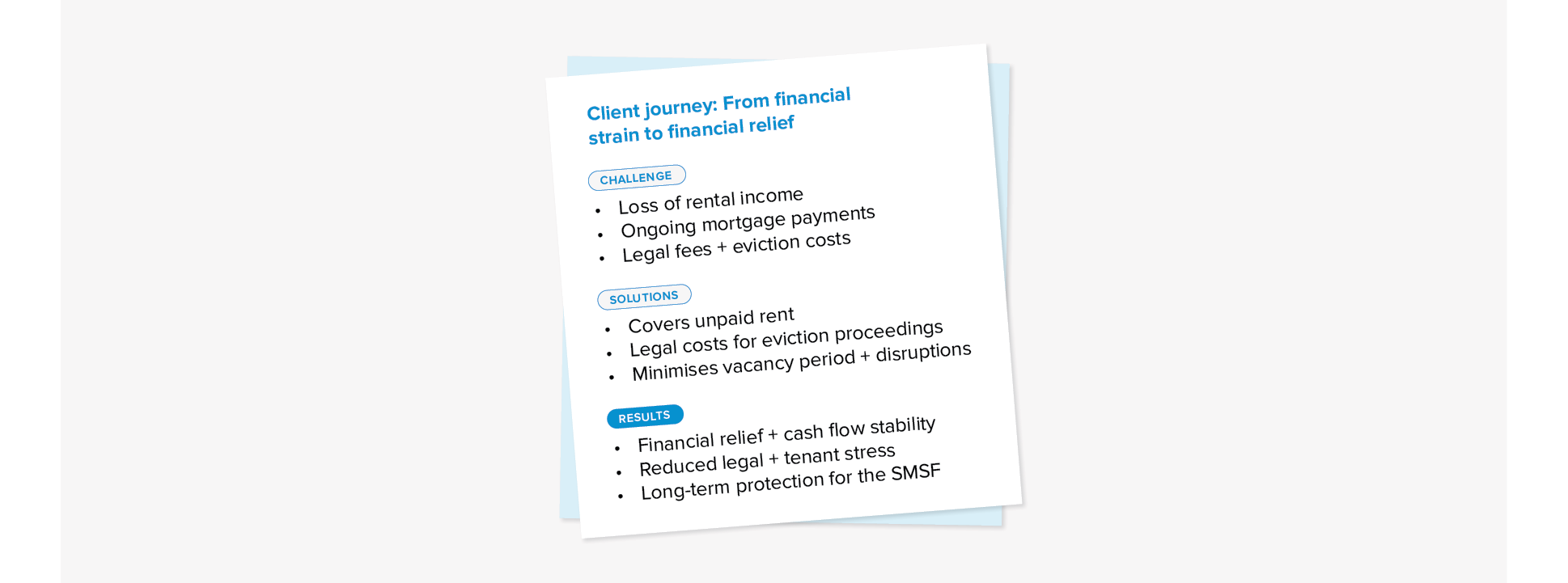

Imagine an SMSF owns a retail property leased to a small business. Due to unforeseen financial difficulties, the tenant defaults on rent payments and ultimately vacates the commercial property before the lease term ends. In this situation, the SMSF faces several immediate challenges:

Mortgage payments: The SMSF is still obligated to meet mortgage payments on the property, despite the loss of rental income. Without insurance, this could put a significant strain on the fund’s finances, potentially leading to cash flow issues or the need to sell the property to cover the shortfall.

Vacancy period: Finding a new tenant can be a lengthy and expensive process. The property may need repairs or refurbishment to attract new tenants, and advertising costs could add up. This creates a prolonged period of lost rental income.

Legal expenses: In some cases, evicting a tenant can involve legal action, which comes with additional costs. The process can take time, adding to the financial strain.

Without commercial property owners insurance that includes tenant rent default cover, the SMSF would be left to bear these financial burdens alone. However, with comprehensive insurance in place, the situation looks much different:

Recovering unpaid rent: The insurance policy may cover unpaid rent, often for up to 26 weeks, allowing the SMSF to recover a significant portion of the rental income that was lost due to the tenant's default. This provides financial relief and helps prevent disruptions in the SMSF's cash flow.

Legal costs: The policy may also cover legal expenses related to eviction proceedings, helping the SMSF manage the costs of recovering the property and securing a new tenant. This is particularly useful in cases where the tenant disputes the eviction or the rent arrears.

Minimising financial disruption: With this additional coverage, the SMSF avoids the financial burden of a prolonged vacancy and the stress of dealing with tenant-related issues. The insurance ensures your commercial property continues to provide the necessary income to support the SMSF’s long-term goals.

In this case, commercial property owners insurance acts as a vital safety net, mitigating the risks and challenges that come with tenant rent default. By having comprehensive coverage in place, the SMSF trustee can rest assured that the property investment is better protected, preserving the integrity of the fund and its members' retirement savings.

At Findex, we understand the unique needs of SMSF trustees and the regulatory environment in which they operate. We can help by tailoring insurance solutions that align with your investment goals while providing protection for unexpected risks like tenant rent default and loss of rental income.

General advice warning: Note that policy terms and conditions apply.

AFSL Brokerage services provided by Findex Insurance Brokers Pty Ltd ABN 17 139 730 528 AFSL 342526