Can we see clearly now? Optical Superstore and the Payroll Tax conundrum

10 February 2020

The structuring of medical and health clinics (e.g. general practice, dental and optometry clinics) is currently under the tax spotlight – particularly whether such businesses have structured their arrangements so that payments to professionals are not subject to payroll tax.

Broadly speaking, payroll tax is payable if the total wages (e.g. salary, commissions, bonuses and certain allowances) paid to employees or deemed contractors for the performance of work exceed a certain threshold. The rate of payroll tax and the tax-free threshold is different in each State and Territory.

However, a recent decision in the Victorian Court of Appeal involving Optical Superstore, may have serious payroll tax ramifications for medical and other health practices that hold money on behalf of specialists that operate from their premises.

The Optical Superstore case

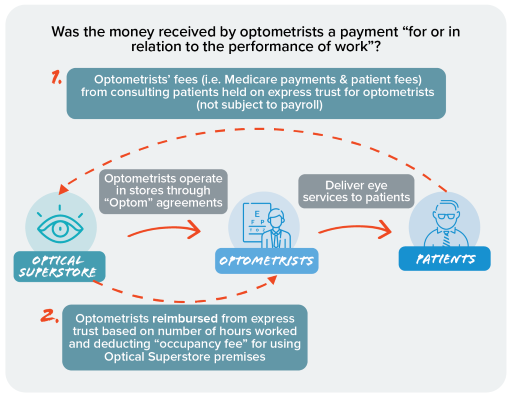

Optical Superstore had a “tenancy and agency” arrangement in place to pay their optometrists for providing services to their patients:

Patients who consulted with optometrists in consulting rooms owned by Optical Superstore did not pay the optometrists directly – instead they paid the optometrists’ fees (i.e. Medicare payments and patient fees) to Optical Superstore that held this money on express trust* for the optometrists. Such payments were not subject to payroll tax.

Optometrists were eventually reimbursed from the express trust* an amount determined by their hourly rate and the number of hours worked (i.e. reimbursement not based on the consultation fees derived) and deducting “occupancy fees” for using Optical Superstore premises.

The issue was whether the distribution of the trust monies to the optometrists were “paid or payable for or in relation to the performance of work” and therefore subject to payroll tax as wages [1].

The Commissioner believed the distributions of the trust monies to the optometrists were wages and therefore issued payroll tax assessments to Optical Superstore. Optical Superstore believed the money they received from the trust should not be subject to payroll tax because the money distributed to optometrists was:

Merely a return of the optometrists’ money (i.e. the distribution did not constitute a payment because it was not possible to receive a payment of money that is already owned by the optometrists); and

Not distributed in relation to the performance of work.

The Victorian Civil and Administrative Tribunal [2] and Supreme Court of Victoria [3] agreed with Optical Superstore and held that payroll tax was not triggered on such reimbursements (i.e. because a return of their money was not a payment “for or in relation to the performance of work”).

However, the Supreme Court of Victoria, Court of Appeal [4] overturned that decision and held that the reimbursement of such money was “paid” to the optometrists for payroll purpose (i.e. payments “for or in relation to the performance of work”) and therefore subject to payroll tax.

What does this mean for medical and health clinic owners and practitioners?

The Court of Appeal decision is an ominous warning for medical and health clinics to re-examine the way they structure payments to any specialists that operate from these clinics. Other “tenancy and occupancy” arrangements, where one entity collects money on behalf of a service provider and then reimburses the service provider, may also be subject to payroll tax.

If you think you may be affected, or know of someone who may be affected, please speak to your Findex adviser, who can assist by conducting a health check of your employment taxes and payroll affairs.

*A bare trust is a type of express trust where property is only held for the benefit of the beneficiary. The trustee must transfer the trust property (i.e. the money held in trust) to the beneficiary on demand.

[1] S35(1) of Payroll Tax Act 2007 (Vic) (PTA)

[2] The Optical Superstore Pty Ltd v Commissioner of State Revenue (Vic) [2018] VCAT 169

[3] Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2018] VSC 524

[4] Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197

)

)

)