Quo Vadis: Holding cost deductions on vacant land

3 December 2019

What happened?

A new law has been introduced that will generally deny tax deductions for costs incurred on holding vacant land. Read this tax snapshot to find out how this change may affect farmers, property developers or property investors that hold vacant land.

Generally, a taxpayer would only be allowed a deduction for costs incurred for the purpose of producing assessable income or carrying on a business. Because it is difficult to determine for exactly what purpose vacant land is held, the new law will generally deny tax deductions for costs incurred on holding vacant land from 1 July 2019 (regardless of when the land was initially acquired). Examples of such holding costs that may be denied under this new law (and may instead be included in the cost base of the land for CGT purposes) include:

Interest or any other ongoing costs of borrowing to acquire the land;

Land taxes;

Council rates; and

Maintenance costs.

Because of this new law, it is therefore important for taxpayers who hold land, to understand:

When land will be considered vacant;

Under what circumstances taxpayers can still claim deductions on holding costs of vacant land;

The differences between the exemption for business use and the exemption for renting out residential premises; and

Whether a deduction for holding costs would be allowed in full or only in part.

The impact of these new changes on primary producers (e.g. farmers), property developers and property investors are briefly considered in this snapshot. Please speak to your Findex adviser for more details.

How does this change affect you?

When will land be vacant?

Determine if there is a substantial and permanent structure on the land.

Land will not be vacant if there is a substantial and permanent structure on the land. A structure includes a building or (any) other thing that is built or constructed on the land.

A structure would be substantial if it is significant in size, value or some other criteria of importance in the context of the relevant property. However, a structure would not be substantial if the structure only supports the use or functioning of another structure (e.g. pipes or powerlines) or only increases the utility of another structure (e.g. a residential garage).

A structure is permanent if the structure is fixed and enduring (even if the structure is not expected to remain standing forever).

The table below analyses whether certain common structures would be substantial and permanent.

| Building or structure on the land | Will this be vacant land? |

1 | Letterbox | Vacant land because a letterbox is not significant in size or value, is not independent from another structure (i.e. not substantial) and is not fixed and enduring (i.e. not permanent). |

2 | Residential garage | Vacant land because the garage is not independent from another structure (i.e. the residential dwelling). |

3 | Commercial parking garage | Not vacant land because a commercial parking garage is substantial and independent to any other structure. |

4 | Grain silo | Not vacant land because grain silo is substantial and independent to any other structure. |

5 | Cattle yards | Not vacant land because cattle yards are substantial and independent to any other structure. |

6 | Irrigation works | Not vacant land because irrigation works are substantial and independent to any other structure. |

However, when constructing or renovating residential premises, such buildings will only be treated as substantial and permanent (and therefore not vacant land) once the residential premises are:

able to be lawfully occupied; and

rented or available for rent.

Land being used in primary production businesses (e.g. a farm) that does not contain any substantial and permanent structure will be vacant land.

Under what circumstances can taxpayers still claim deductions on vacant land?

These changes can only affect individuals, SMSFs, partnerships or trusts.

They do not affect companies, non-SMSF superannuation funds, and other institutional investors. For them, it is business as usual. For example, companies that own vacant land would still be able to deduct their holding costs.

In contrast, individuals, SMSFs, partnerships or trusts (that do not have institutional investors as their members) will only be allowed to deduct holding costs on vacant land if:

the land is being used by them (or by their spouse, child, affiliate or connected entity) in carrying on a business;

the land is vacant because of a natural disaster or exceptional circumstances;

the vacant land is being rented out by a primary producer; or

the vacant land is being rented out and it is being used to carry on a business.

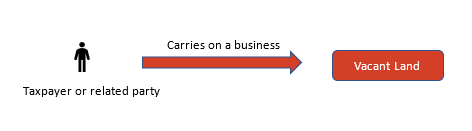

Land is being used by the relevant taxpayer or a related party in carrying on a business

This exception is relevant for a taxpayer or a party related to the taxpayer (i.e. the taxpayer’s spouse, child under 18, the taxpayer’s affiliate, an entity of which the taxpayer is an affiliate or an entity that is connected with the taxpayer) that is carrying on a business on the vacant land.

This exemption may prove difficult from a practical point of view – particularly because it is necessary to determine if entities involved are affiliates or connected with the taxpayer. For example, a business carried on by your child who is under 18 years of age, may qualify for this exemption, whereas a business carried on by your adult child may not qualify for this exemption (because you and your adult child may not be affiliates of each other).

Determining when entities are affiliates or connected with each other can be a complicated exercise. Broadly:

an individual or a company will be an affiliate of the taxpayer if the individual or company is expected to act according to the taxpayer’s directions or wishes or in concert with the taxpayer; and

an entity will be connected with another entity in terms of control (i.e. usually if the entity has at least 40% direct and indirect control of another entity).

Land is vacant because of a natural disaster / exceptional circumstances

This exception is relevant for taxpayers who had a substantial and permanent structure on their land that was subsequently affected by a natural disaster (e.g. fire or flood) or unexpected exceptional circumstances (e.g. substantial building defects such as what happened to the Opal Tower) that caused the land to become vacant once again.

In such a case, the deduction for holding costs would generally only be available for three years after the natural disaster or exceptional circumstances occurred.

In terms of this new exception there are two issues of note which are likely to be the subject of future clarification:

It does not appear to require the landowner or their related party to carry on a primary production on land they own. It is therefore questionable whether a landowner may qualify if they or their related entity are carrying on a primary production business on property they lease, rather than own; and

It does not appear to limit the type of land that qualifies for the exception. That is, it does not specifically state it only applies to primary production land owned by the landowner.

It is anticipated that a future ATO ruling on these provisions will provide guidance on the ATO’s view on these points.

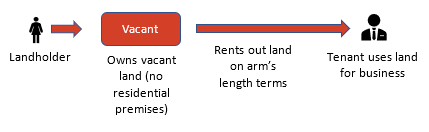

Vacant land rented out and used to carry on a business

This exception is relevant where a landholder rents vacant land to a tenant on arm’s length terms, and the land is then used in carrying on a business.

Differences between the exemption for business use and the exemption for renting out residential premises

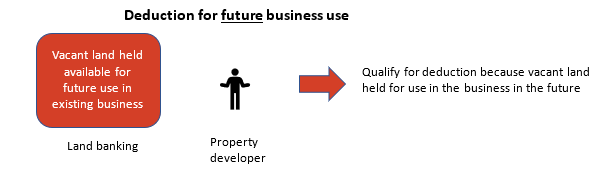

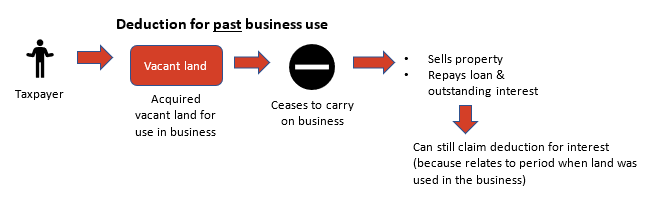

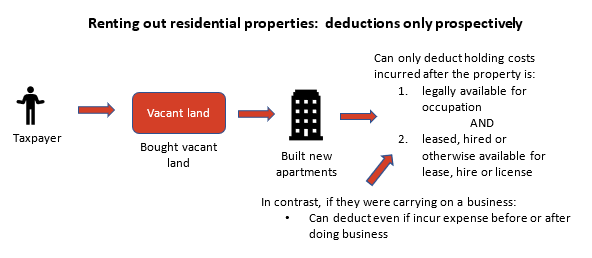

As illustrated in the diagrams below, a deduction would also be available for future and past business use of vacant land.

The diagram above illustrates that the holding cost deduction should be available for a property developer provided the land was held ready for use in a property development business. Generally, a backyard subdivision will not constitute a property development business.

It is important to note that renting out a residential property by an individual, partnership or trust is not generally carrying on a business. Consequently, in most cases, property investors can only deduct holding costs prospectively from the date the residential premises are able to be occupied under the law (i.e. occupancy certificate issued) and once the premises are available for lease, hire or license.

Property investors who are not carrying on a business in respect of those properties will therefore be denied a deduction for holding cost up to the time the residential property is able to be lawfully occupied and rented or available for rent.

Full or partial deduction for holding costs?

Most holding costs relating to vacant land will relate to a single property title and therefore if there is a substantial and permanent structure on the land, the land will not be vacant, and the holding costs may therefore be deductible in full. For example, if a taxpayer has two windmills on a thousand acres of land (on one land title), the holding cost should be deductible in full – for the taxpayer’s business or leasing/agistment – because the thousand acres of land would not be vacant.

In other cases – for example when a business is only carried on a part of the land - only a proportionate deduction for the holding costs would be allowed in respect of only that part of the land.

The vacant land rules only apply to costs of holding the land. They do not apply to other costs, such as interest on borrowings used to build business or rental structures on the land (as opposed to the mere holding). The interest on the construction loan would still be tax-deductible.

How can Findex help you?

We understand that many of our clients (especially farmers, property developers and property investors) holding vacant land may be affected by these new law changes.

As these changes only recently became law and apply from the current income tax year onwards, please speak to your Findex adviser so that we can conduct a health check of your affairs and help you determine whether you would still be able to qualify for deductions going forward.

)

)

)