The role of specialists in building an investment portfolio

) Jonathan Scholes

Jonathan Scholes29 March 2022

A well-managed investment portfolio can quickly help you accumulate wealth, protect your assets, diversify your income, and most importantly, outgrow inflation. But, what does ‘well-managed’ mean when it comes to building an investment portfolio and who are the experts involved in the portfolio construction and management process?

This guide delves into the type of specialists wealth management firms use to help build and manage their investment portfolios and how they add value to client portfolios.

Keep reading.

What types of specialists are involved in building an investment portfolio?

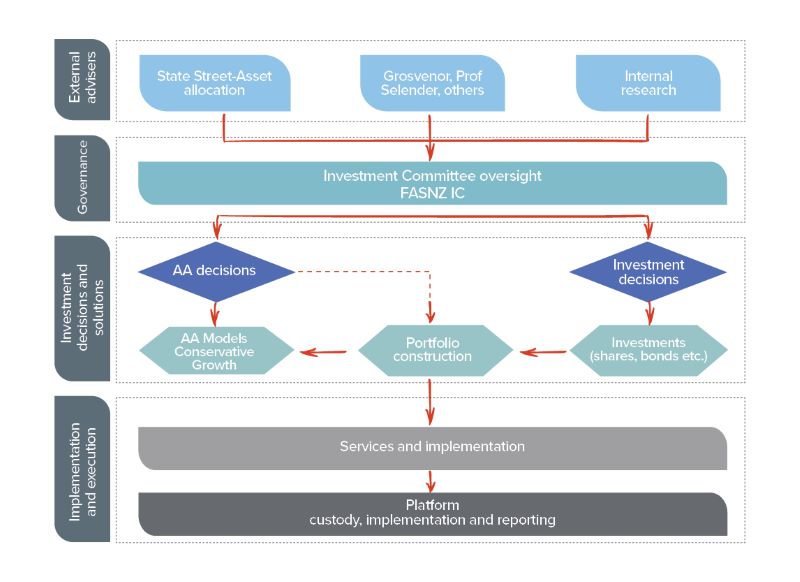

There are three main specialists involved in building an investment portfolio from scratch. They include:

Asset consultant

Research and investment committee

Fund manager

These three experts collaborate to manage your assets and help you make the right investment decisions.

The selection process starts by selecting the asset consultant followed by the research and investment committee. This group then select the right fund manager and work with your financial adviser to provide the appropriate advice to you.

The Findex Investment Committee has the added oversight of three independent investment committee members including a client advocate, whose sole purpose is to ensure that any investment decisions made by the investment committee are in the best interests of investors.

What is each specialist’s role when building an investment portfolio?

Each team of specialists involved in building an investment portfolio understands your goals and your finances. So, they use that information to choose what can work for you according to the current market condition and your goals.

Asset consultant

An asset consultant works on a top-down economic basis to help you choose the best class of assets. They provide well-timed decisions to ensure client gets a sustainable, efficient, and profitable investment.

There are many asset types, including stocks, cash, and bonds. Deciding on the right one for you is not always easy, and that's why asset consultant specialists exist. These experts help select the best mix of asset investments so that you can make an informed decision when building an investment portfolio.

Research and investment committee

The research team goes through the recommendations offered by the asset consultants and provides further advice on what could work best for clients.

The research team forwards their recommendations to the investment committee who work through a formal review and approval process. At that stage, a fund manager may be engaged to implement the asset consultant’s view and will again be approved by the investment committee.

The Research team will then provide the appropriate portfolio structure to your adviser, who will work with you to help ensure your personal goals can be met.

Fund manager

A fund manager manages the overall trading activities. They oversee your pensions, mutual funds and collaborate with the research and investment committee members to make significant investment decisions for you.

What are the benefits of specialists when building an investment portfolio?

Here are the three main benefits of engaging a specialist when building an investment portfolio in Australia.

1. It eliminates guesswork

When investing your hard-earned money, the last thing you want to do is make guesses.

There’s a big difference between speculating and real investing when building an investment portfolio. And one of them is far more likely to result in you losing money!

Investment portfolio specialists eliminate the guesswork as clients are receiving expertise from specialist teams at every stage of the wealth management value chain.

2. Provides greater certainty of outcome

Using investment specialists provides clients with confidence and provides more certainty to clients and advisers alike because you are engaging with specialist teams, who enhance the client value proposition at every stage of building an investment portfolio.

Specialists allow advisers and their clients to focus on meeting clients’ long-term investment goals and objectives, and expectations of risk and return. Which means you can focus on different vital aspects of your life, knowing that your investments are well taken care of.

3. Better collaboration between advisers and clients reduces risk

Building an investment portfolio is a significant financial decision that requires expertise, specialist research and time.

Working with a team of financial experts across the investment journey provides you with the support and guidance you need to make critical decisions. And it enhances collaboration between you and your adviser, which helps increase your confidence, minimises risks, and increases your chances of meeting your goals.

What can specialists teach clients about building an investment portfolio?

Investment portfolio specialists are experts, and you can learn a few vital things from them. Here are just a few suggestions of what you could learn by collaborating with specialists.

1. Disciplined and long-term investing always wins

The more you invest, the greater your return on investment stands to be. However, staying the course and remaining disciplined are critical to your long-term success.

Markets fluctuate but the long-term strategies of investment specialists won’t. While it may be tempting to chase speculative investments and short-term gains when building an investment portfolio, investment specialists have embedded strategies that remove the emotion from trading, which can hamper investor returns.

In an investment environment of low returns, working with a team of experts, who each have their own area of deep specialisation, is in the best interests of any investor looking to generate genuine returns over the long-term.

2. Structure and diversification allow you to focus on what is important

Diversification reduces the risks of loss. Investment specialists are experts at choosing the most suitable mix of investments, be it assets, sectors, or currencies, to help protect your investment portfolio from market downturns.

Professionally constructed investment portfolios blend passive, semi-active and active strategies to help manage risk. Across each asset class, portfolios are constructed to generate outperformance relative to their respective asset class benchmarks, while ensuring drawdowns are minimised over annual periods.

So, working closely with investment specialists can help you learn more about the importance of having a good structure when making diversified investments for better focus.

3. Risk and return are related

The higher the potential return of an investment is, the higher the risk.

Risk and returns have a direct relationship, but diversification helps to manage them. Investment specialists have a deep understanding of the possible risks and returns of an investment and understand how to diversify investments to help maximise the likelihood of achieving your goals with the minimum amount of acceptable risk for your individual circumstances.

Working with specialists can help you learn the relationship between risks and returns and use the knowledge to make better investment decisions in the future.

Conclusion

Building an investment portfolio requires expertise to help minimise risks and losses. The Findex Wealth Management team can work with you and our team of specialists to create an investment portfolio that works to achieve your goals. If you’d like some help and guidance on building an investment portfolio in this environment of low returns, please get in touch with our team.

)

)

)

)